Get the free daycare budget template

Show details

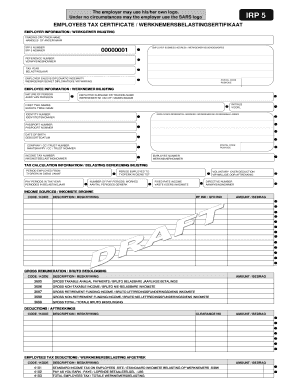

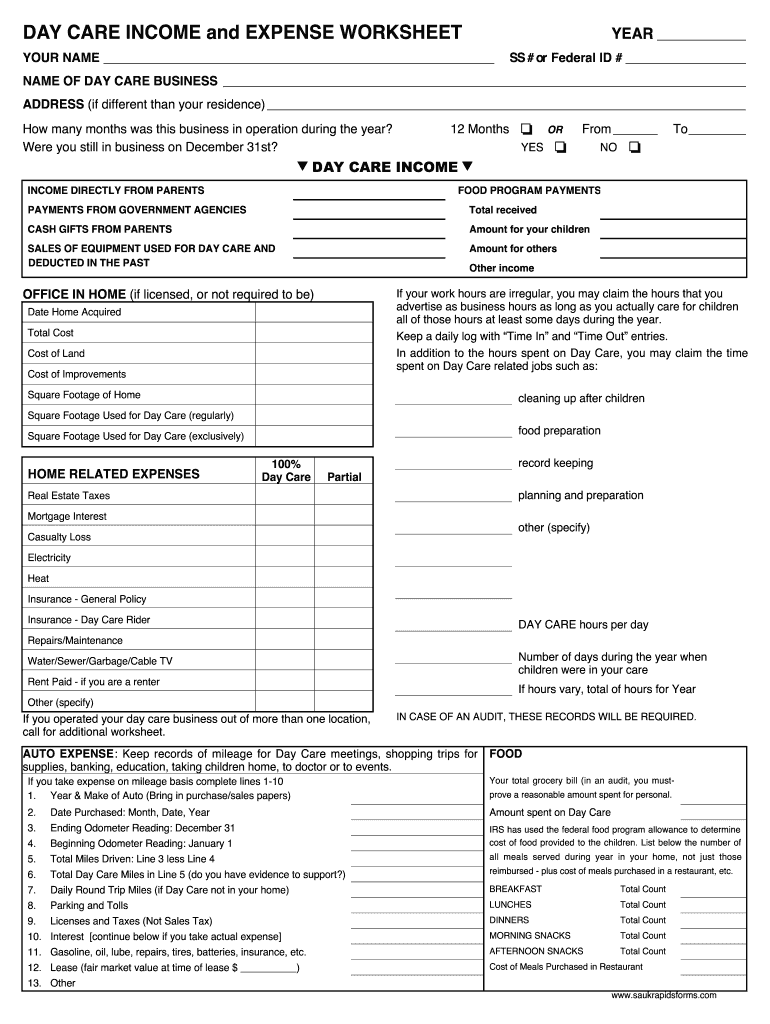

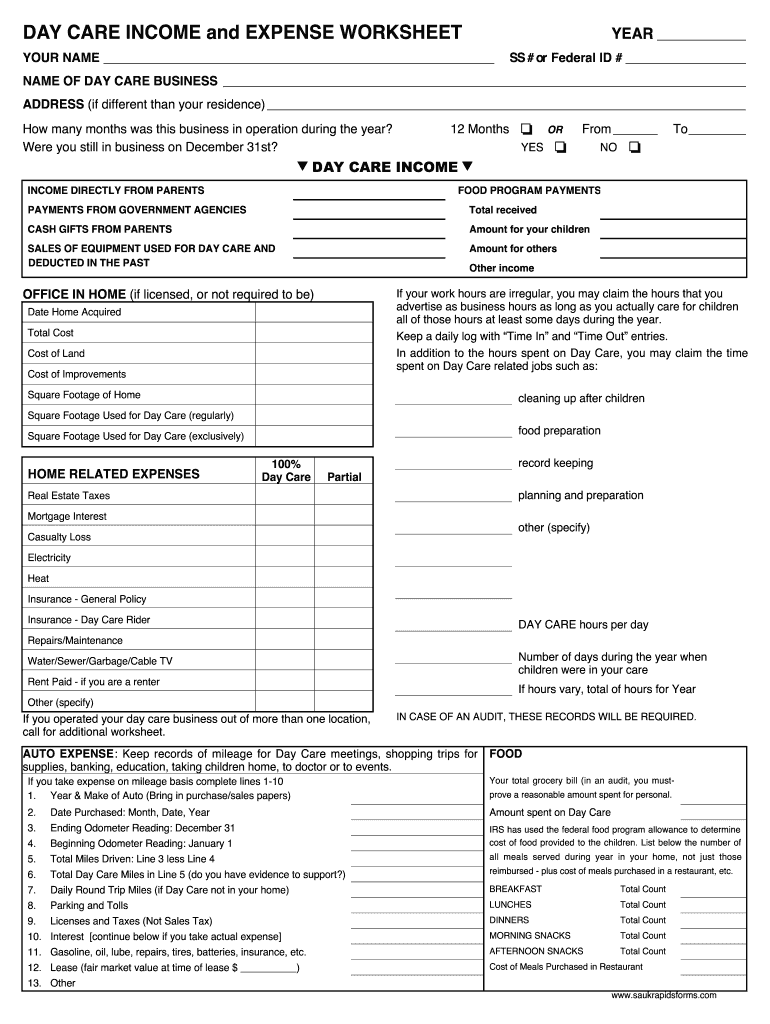

DAY CARE INCOME and EXPENSE WORKSHEET YEAR YOUR NAME SS # or Federal ID # NAME OF DAY CARE BUSINESS ADDRESS (if different from your residence) How many months was this business in operation during

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign daycare income and expense worksheet form

Edit your daycare expenses list form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your daycare budget example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit daycare spreadsheet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit daycare payment spreadsheet template form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to fill out printable 08 form

01

To fill out a monthly daycare expense spreadsheet, start by gathering all the relevant information such as the names of the daycare providers, the dates of service, and the corresponding costs.

02

Open a spreadsheet program like Microsoft Excel or Google Sheets and create columns for each piece of information you need to track, such as the daycare provider's name, date of service, and cost.

03

Enter the information for each daycare expense into the corresponding cells of the spreadsheet. Be sure to accurately record the dates and costs for each day of daycare.

04

If you have multiple daycare providers, create additional rows for each provider and enter their information separately.

05

Sum up the total costs for each daycare provider by using the SUM function in the spreadsheet program or manually add up the costs.

06

Consider adding categories or tags to further categorize the expenses, such as "food", "supplies", or "field trips", if you want to track more specific details of your daycare expenses.

07

Periodically review and update the spreadsheet as new daycare expenses occur, making sure to record any changes or additional costs accurately.

08

Anyone who wants to track and manage their monthly daycare expenses would benefit from using a monthly daycare expense spreadsheet. This includes parents or guardians who want to keep a record of their daycare costs for budgeting purposes, as well as individuals who may need to provide documentation of daycare expenses for tax purposes or reimbursement from an employer.

Fill

childcare budget template

: Try Risk Free

People Also Ask about in home daycare tax deduction worksheet

Does the IRS ask for proof of child care expenses?

You need to be able to verify childcare expenses in case of an audit. If you don't have proof that you paid these expenses, you can't claim the credit. You don't have to bring the receipts to your tax pro or mail them with your return. Just keep them with your personal records for at least three years.

How does the IRS verify child care expenses?

The IRS goes about verifying a provider's income by evaluating contracts, sign-in sheets, child attendance records, bank deposit records and other income statements.

How do I report child care expenses on my taxes?

To claim the credit, you (and your spouse, if you're married) must have income earned from a job and you must have paid for the care so that you could work or look for work. You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2022).

How do I make a daycare budget?

Calculate your Revenue. Start by determining your total monthly revenue. Determine Monthly Costs. The next step is to determine your monthly expenses. Determine Profit & Loss. If you completed the first two steps this section should be pretty easy. Create an Emergency Fund. Fill out your Budget.

What is dependent care expenses?

Dependent care includes the cost for supervision of teenage children (under age 18), as well as care of a child or disabled adult not part of your SNAP household (for example, a foster child or non-citizen child).

Does IRS verify child care expenses?

In-home child care provider taxes must include careful documentation in case of an audit. The IRS goes about verifying a provider's income by evaluating contracts, sign-in sheets, child attendance records, bank deposit records and other income statements.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send calid care grocery expence reced to be eSigned by others?

When you're ready to share your daycare expense tracker, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in child care center budget template without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your daycare startup budget sample, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit daycare budget template excel on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing daycare expense form.

What is monthly daycare expense spreadsheet?

A monthly daycare expense spreadsheet is a document used to track and organize all expenses related to daycare services on a monthly basis. It helps parents and guardians monitor their spending for childcare.

Who is required to file monthly daycare expense spreadsheet?

Parents or guardians who pay for daycare services for their children may be required to file a monthly daycare expense spreadsheet, especially if they seek tax deductions or reimbursements.

How to fill out monthly daycare expense spreadsheet?

To fill out a monthly daycare expense spreadsheet, input all relevant expenses including tuition, supplies, and additional fees in the designated columns, and sum total costs at the end of the spreadsheet.

What is the purpose of monthly daycare expense spreadsheet?

The purpose of the monthly daycare expense spreadsheet is to provide a clear overview of childcare costs, assist in budgeting, and help users keep track of their financial commitments related to daycare.

What information must be reported on monthly daycare expense spreadsheet?

Information that must be reported includes the date of expense, description of the service or item, the amount spent, and any receipts or documentation supporting those expenses.

Fill out your daycare budget template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Daycare Accounting Spreadsheet is not the form you're looking for?Search for another form here.

Keywords relevant to daycare expense spreadsheet

Related to sample budget for a daycare center

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.